Just set up a new limited company or transitioned from a sole trader? Congrats! Running a limited company can have some fantastic benefits and it’s an exciting next step on your journey.

If you’ve made the switch from being a sole trader, there are slightly different things to consider compared to just completing a tax return as a non-incorporated business. Whilst owning a limited company comes with a lot of great benefits, it also requires more filings with government departments each year.

Knowing exactly what you have to pay and when can be difficult, especially as a new limited company owner. That's why we're breaking it down for you in this simple guide.

Here’s what you’ll need to file as a minimum each year:

Company Accounts

These need to be filed with Companies House within 9 months of your year end. So, if your year end is 31st March, your accounts need to be filed online by 31st December.

Corporation Tax Return aka CT600

Companies pay Corporation Tax (currently 19%) on the profits that they report for their year. This is due 9 months and 1 day after your year end. (This is the date your company’s accounting period ends.) The relevance of the extra day? Who knows. Just file it at the same time as your accounts.

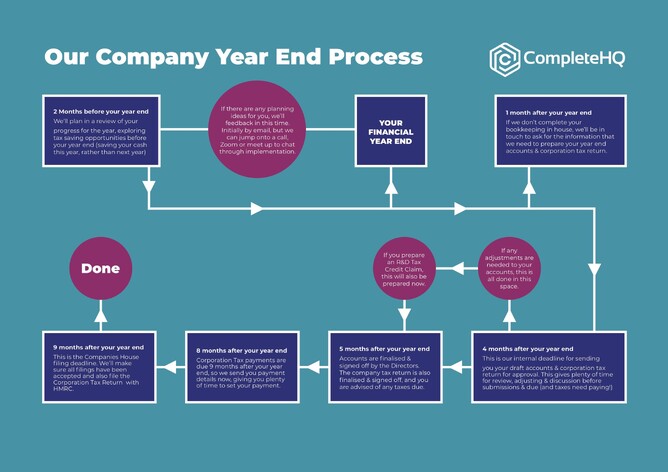

Here’s a quick outline of how we help the businesses that we work with keep on top of these things.

Confirmation Statement

This is an extra form that you need to file with Companies House each year. It confirms who the directors and shareholders of the company are and ensures the company record is up to date. You should be able to take care of this yourself, but most accountants will do it for you too (like us!). These usually need to be filed on the anniversary of the company being formed, aka it’s “Date of Incorporation”.

Self Assessment Tax Return

If you’ve transitioned from a sole trader to a limited company, you still have to file a personal tax return to HMRC. It’s a requirement of HMRC that all directors file a return. The return will likely be a lot simpler now, as it’ll tell HMRC of any income you’ve received from your company. Same deadline as always for this one, 31st January.

VAT Return

If your company is VAT registered, you’ll usually have a VAT return due at the same time as your company year end. You must register for VAT and account for it if your annual turnover exceeds the VAT threshold of £85,000 per year (for the 2020/21 tax year). VAT registered companies must also complete a quarterly VAT return to HMRC. You must include all the VAT you’ve added to your sales and then deduct the amount of VAT you’ve paid on business expenses. The difference between these is the amount of VAT payable to HMRC. For VAT registered businesses, the VAT return is due at the end of the month following the end of the quarter covered by the return.Staying organised

The key to running a successful business is organisation. Leaving things to the last minute could result in rushed accounts, missed deadlines and mistakes, which means unnecessary fines from HMRC and Companies House. Keep track of what you have to pay and when, and don’t leave things to the last minute. This includes staying on top of the bookkeeping.

Whilst it might not be the most glamorous part of running a business, good bookkeeping is essential for keeping your tax costs down. A good bookkeeping system that allows you to see your financial information in real time is crucial for assessing how your business is performing and for reviewing its current tax position.

Software like Xero and Receipt Bank allow you to easily record your transactions. When used correctly, they can also help you automate the process so your financial information flows seamlessly into your accounting software. Just make sure you regularly reconcile your transactions in your accounting software to keep everything up to date. Trust us, you’ll definitely reap the rewards of these good habits further down the line!

When it comes to your accounts, it’s also important that the information you’re submitting is correct, otherwise you could face fines and penalties. This is where a good accountant comes in. With a proactive approach and a good accountant to help prepare these records for you, you can avoid unnecessary fines and save yourself a lot of time and stress in the long run.

Financial planning

The approach to your year end is the perfect time for some financial planning to help keep your tax bill down. A proactive accountant will help you consider any tax saving opportunities in the run-up to your year end, like taking advantage of tax-free benefits or dividends. They can also help you implement a tax planning strategy going forward so you're always prepared for the future.

**This article is an extract from our Limited Company Owner Guide**